News

March 29, 2022

Novo Holdings and HealthQuad invest in Qure.ai

The funding will accelerate the AI-driven healthcare company’s global market expansion and support new product development

Qure.ai (‘Qure’), one of the leading health tech firms using Artificial Intelligence (AI) for medical imaging diagnostics, today announced that it had secured $40 million in a funding round led by Novo Holdings and HealthQuad, supported by existing investor Mass Mutual Ventures.

Qure.ai will use the new investment to extend and strengthen its global reach, especially in the US and Europe, and intensify product development for critical care and community diagnostics.

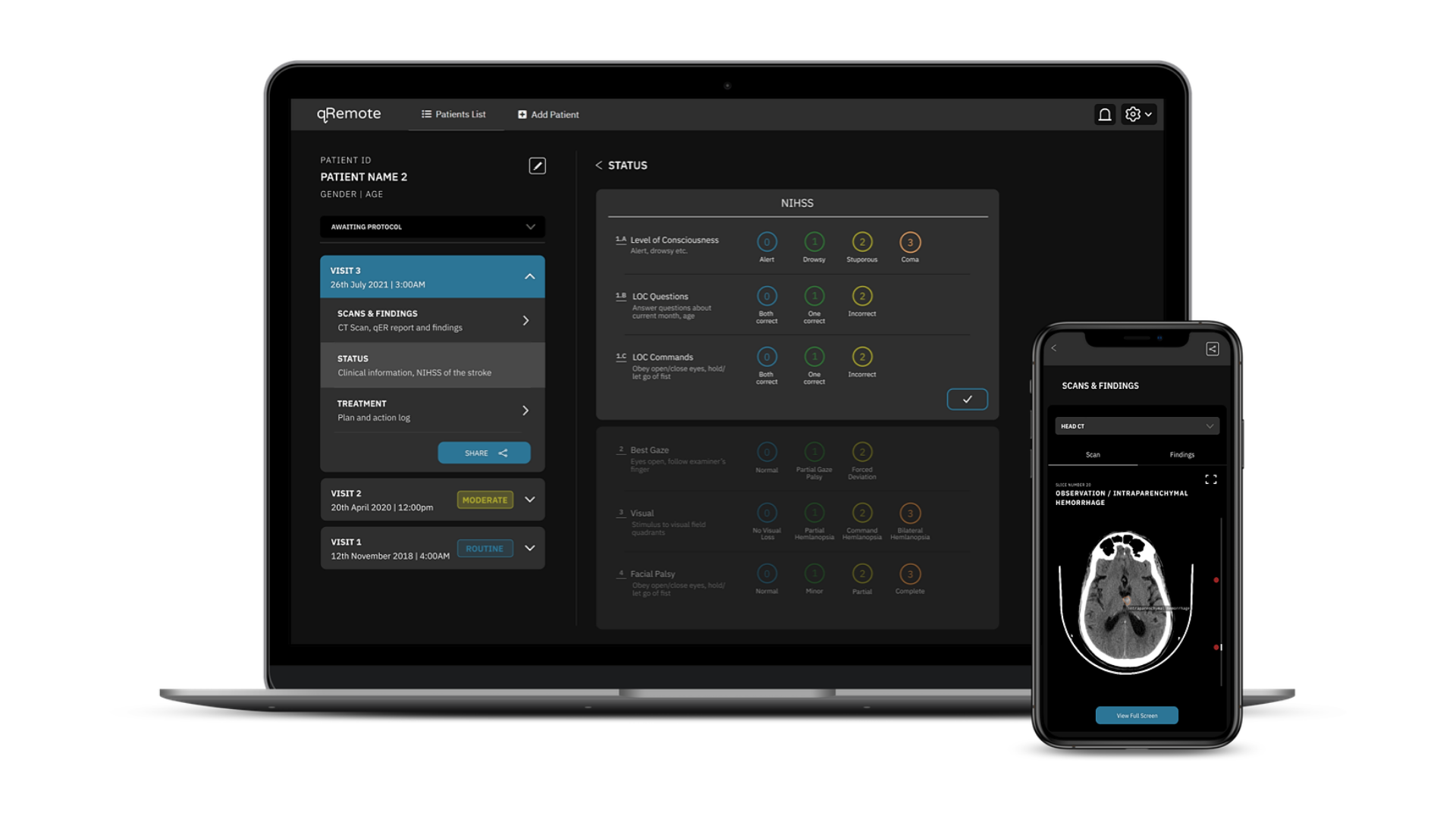

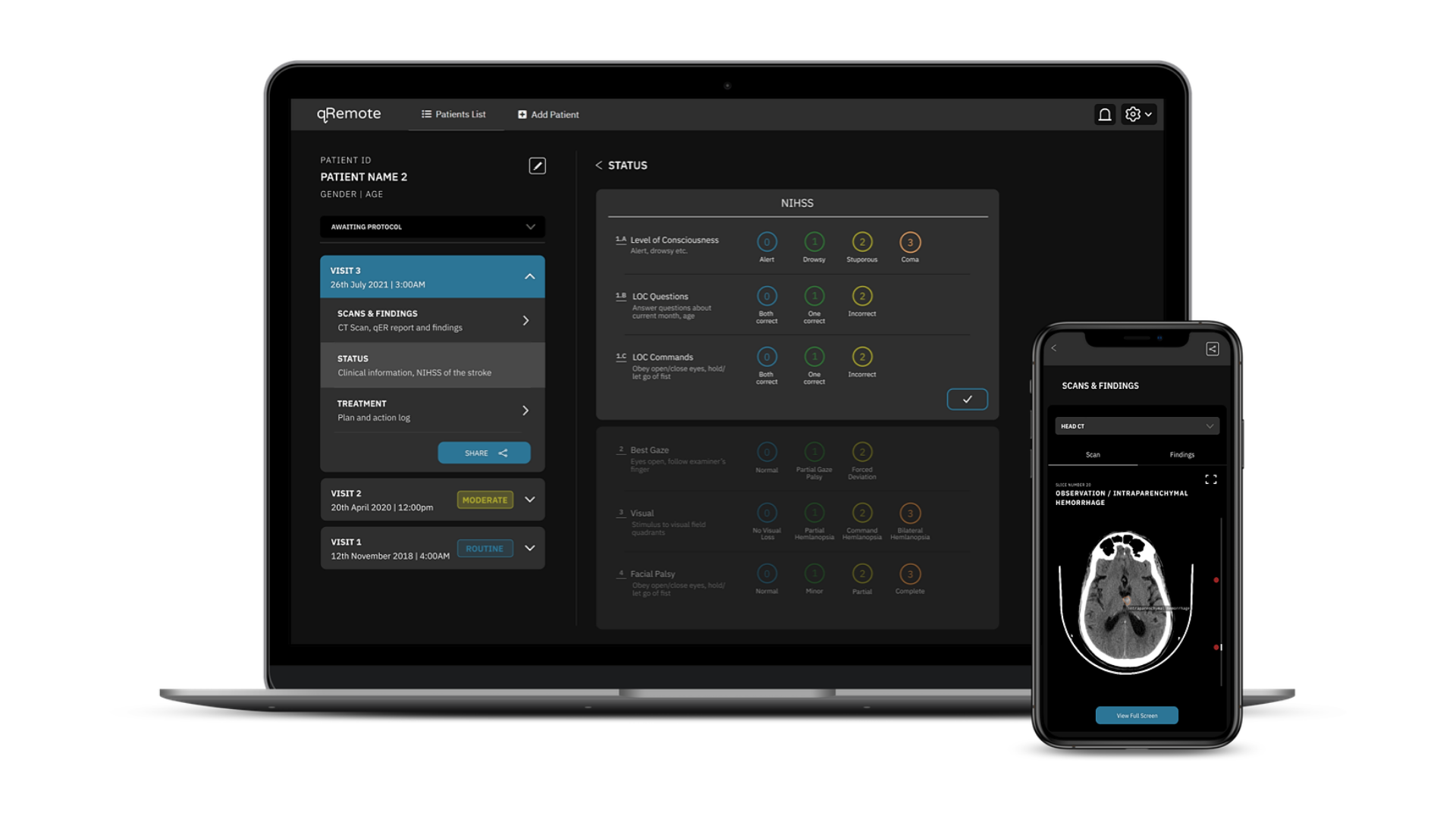

Qure.ai has created a niche for itself with advanced technology that reads and interprets medical images such as X-rays, CTs and ultrasounds in less than a minute, making equitable and high-quality healthcare a reality across the globe. Qure’s AI solutions are FDA-approved, CE-certified and evaluated by the World Health Organization.

Qure.ai’s automated medical imaging tools can shorten the time to diagnosis while enabling physicians to triage medical cases more effectively, especially in time-sensitive situations. This helps healthcare providers to identify critical scenarios within minutes – versus hours – to avert fatalities and improve the quality of patient care. In other settings, where adequate, skilled specialists may not be available, Qure’s technology is used as the first level of screening for many infections and noncommunicable conditions.

Dr Amit Kakar, Senior Partner, Head of Novo Holdings Equity Asia, said: “We are very pleased to join the outstanding team at Qure_.ai_ and to contribute to their efforts in providing world-class AI solutions in the imaging space to benefit patients worldwide. Qure_.ai_ is at the forefront of transforming diagnostics in both acute and chronic ailments, which is fully aligned with our mission of advancing high_–quality and accessible healthcare using innovation and digitisation. Further, we are excited to_ connect Qure_.ai_ to our portfolio partners_, since_ we see several promising synergies.”

Novo Holdings is a world-leading healthcare and life sciences investor with a focus on creating long-term, sustainable value. Headquartered in Copenhagen with offices in San Francisco, Boston, London and Singapore, Novo Holdings has a portfolio of more than 150 companies.

Charles–Antoine Janssen, Chief Investment Officer, HealthQuad, said: “We are thrilled to be part of the Qure team. Their world-class AI technologies adhere to the most stringent international standards and have made high-quality, accessible care a reality. We remain committed to collaborating with innovative firms that work to improve global healthcare infrastructure.__”

“It’s no accident that Qure is one of the leading startups thriving in the health tech sector. Through noteworthy collaborations with ministries of health and government entities like the NHS, pharmaceuticals like AstraZeneca and international advocacy groups like StopTB, among others, Qure has already built a network of global commercial partnerships. The pandemic has also accelerated the shift to digital transformation, and we are proud to back their growth,” added Ajay Mahipal, Director, HealthQuad.

HealthQuad is India’s leading digital health–focused venture capital fund, with assets under management of $200 million across two funds. Its focus is to nurture innovative models that radically improve healthcare access and affordability-leveraging technology.

Prashant Warier, CEO and Founder, Qure.ai, said: “Every year our technology helps more than 4 million people across 50 countries. Our goal is to continue being bullish in our market expansion, especially in the US and Europe. We are committed to aiding healthcare professionals in diagnosing illnesses faster and with more detail and accuracy while automating most of the routine work. This is a win for everyone involved in healthcare, especially for patients across the globe who will benefit from vastly improved health outcomes.”

Ryan Collins, Managing Director, MassMutual Ventures said: “We have been incredibly impressed with Qure’s progress since we first invested over two years ago. The team is exceptional and the progress on product development, now across many different imaging modalities and use cases, as well as global expansion, has been outstanding. We are very happy to continue supporting Qure and welcome Novo Holdings and HealthQuad as partners.”

Existing investors include Fractal Analytics and Sequoia Capital.

About Qure.ai

Qure.ai is a breakthrough Artificial Intelligence (AI) solution provider that is disrupting the radiology status quo by enhancing imaging accuracy and improving health outcomes with the assistance of machine-supported tools. Qure.ai taps deep learning technology to provide automated interpretation of radiology examinations like X-rays, CTs, ultrasounds and MRI scans for time- and resource-strapped medical imaging professionals – enabling faster diagnosis and speed to treatment. Qure.ai is helping to make healthcare more accessible and affordable to patients worldwide.

About Novo Holdings A/S

Novo Holdings A/S is a private limited liability company wholly owned by the Novo Nordisk Foundation. It is the holding company of the Novo Group, comprising Novo Nordisk A/S and Novozymes A/S, and is responsible for managing the Novo Nordisk Foundation’s assets.

Novo Holdings is recognised as a leading international life science investor, with a focus on creating long-term value. As a life science investor, Novo Holdings provides seed and venture capital to development-stage companies and takes significant ownership positions in growth and well-established companies. Novo Holdings also manages a broad portfolio of diversified financial assets. Further information: www.novoholdings.dk.

About MassMutual Ventures (MMV)

MMV is a multistage, global venture capital firm investing in digital health, financial technology, enterprise software, and cybersecurity companies. We help accelerate the growth of the companies we partner with by providing capital, connections and advice. MMV’s sole limited partner is MassMutual, a Fortune 500 financial services company with assets under management of $460 billion (Dec. 2021).